19 Mar Key Findings from the 2024 NECTA Innovation Index

Powered By:

The NECTA Innovation Index is a yearly tracking survey that identifies industry trends, measures consumer attitudes, and generates data to inform NECTA members and policymakers in their decision making. The data delivers crucial insights about the connectivity and telecommunications industries, consumer broadband usage, and public opinion on important topics like broadband access, security, and municipally-owned-and-managed networks. The Innovation Index empowers NECTA, its members, business leaders, and policymakers across New England with actionable data that measures what consumers want from the connectivity and telecommunications industries.

The mixed methodology (online, randomized phone, randomized text-to-web) n=2000 sample survey of New England voters who are also broadband or cable consumers was fielded from 10/7/2024 to 10/16/2024 and has a margin of error of +/- 2.2%. The sample mirrors up-to-date consumer and voter representation throughout New England to ensure an accurate depiction of public sentiment.

Key findings from the 2024 NECTA Innovation Index

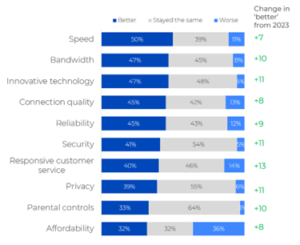

1. New England consumers are very happy with their broadband service. 2024 saw a net satisfaction rate of 90% among broadband customers, a +3% increase from 2023. Notably, the majority of New England customers are satisfied with every aspect of their broadband service – like reliability (consumers’ first priority), affordability (consumers’ second priority) and speed / connection quality (consumers third priority).

Consumers recognize the work that the broadband industry has done to improve each of these service aspects over the last year.

The largest gains are in responsive customer service (+13%), security (+11%), and innovative technology (+11%).

2. Self-reported cable subscriptions are up across the board. Data suggests an 11% rise in cable video subscriptions over 2023. The majority of these gains appear to come from younger customers. Younger consumers 18-34 reported a +13% gain from 2023. Younger consumers are not only more likely to report having a cable subscription since 2023, they’re also more likely than at any point in our tracking to use their cable subscription as their main source of entertainment, signaling declining popularity of paid streaming services.

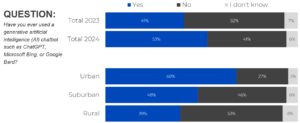

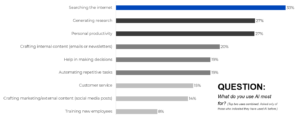

3. More consumers are becoming comfortable with Artificial Intelligence (AI) but questions remain about the future of regulations and security. A majority (53%) of New England consumers have used a generative AI chatbot – a rise of 12% from 2023. The most common AI uses are searching the internet (33%), generating research (27%) and increasing personal productivity (27%).

Despite the increases in usage and comfortability with this evolving technology, nearly three quarters (74%) believe that AI poses a threat to online security. The survey shows that certainty at the federal level remains important: a near majority (47%) of New England consumers believe that the federal government is best equipped to regulate AI, compared to only 10% who say local, municipal or state governments. This indicates that New England consumers want a standardized, nationwide regulatory framework instead of a patchwork of legislations that might vary wildly from state to state.

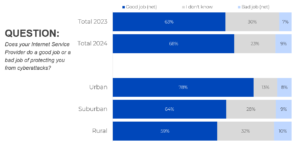

4. New England consumers overwhelmingly approve of cybersecurity measures implemented by private internet providers. 3-in-10 consumers are intensely concerned about the possibility of cyberattacks disrupting their service. Another 55% are “somewhat concerned.” That said, more than three-quarters (68%) believe that their broadband provider is doing a good job of protecting them from cyberattack – an increase of 5% from 2023.

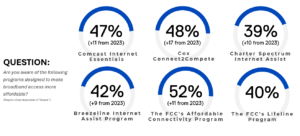

5. New England’s private broadband providers are taking the lead on internet access for low-income households. In both rural and urban areas alike, low-income households are much more aware of internet affordability programs than they were last year. Most industries have responded to inflationary rises and costs of doing business by increasing their products’ prices to consumers. Private internet providers continue to find ways to increase affordability and access for their consumers.

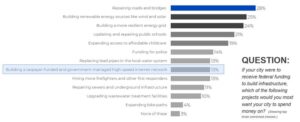

6. Government owned and managed networks are NOT a voter priority. There are many other issues and improvements voters prioritize with their tax money, such as physical infrastructure, a more resilient energy grid and updating public schools. A majority of New England voters also trust networks run by private providers more than ones run by municipal government for use in their homes.

Conclusion:

New England consumers recognize the value of their cable and internet service providers. By measuring year-over-year perception data, we can quantify the impact of the most innovative and connected companies in the region. For example…

- Consumers are more concerned than last year about potential cyberattacks and keeping their data safe and secure. They also are more likely than last year to say that private ISPs are doing a good job of answering that challenge and keeping them safe.

- Low-income households are reporting a much higher awareness of broadband affordability programs provided by the region’s companies. Private providers are leading the way in ensuring that everyone has equal access to affordable, high-quality internet service.

- Satisfaction for the products and services offered by New England’s connectivity companies remains sky high – a testament to the innovations and improvements in which they’ve invested.

The 2024 Innovation Index demonstrates that consumers trust and rely on New England’s connectivity and telecommunications companies to get them connected and keep them protected. The 2024 NECTA Innovation Index was conducted by Seven Letter Insight. Full survey results can be found here.